Rockland Tax District

Ledgers & Journals

Since May 1, 2009

|

|

Cash

on hand April 30, 2009 |

|

290,256 |

|

|

+Taxes

Collected in June & Sept ‘09 (567,311

levied in Nov ’08) |

353,641 |

|

|

|

+Other

Revenues |

14,742 |

|

|

|

+Proceeds

from Asset Sales |

|

|

|

|

+/-

discrepancy |

|

|

|

|

-Operational Costs |

239,942 |

|

|

|

-District Expenses |

126,806 |

|

|

|

-Ambulance

Contract |

|

|

|

|

Cash

on hand April 30, 2010 |

|

291,891 |

|

|

+Taxes

Collected in June & Sept ‘10 (584,542

levied in Nov ’09) |

571,061 |

|

|

|

+Other

Revenues |

7,700 |

|

|

|

+Proceeds

from Asset Sales |

|

|

|

|

+/-

discrepancy |

|

|

|

|

-Operational Costs |

301,112 |

|

|

|

-District Expenses |

132,280 |

|

|

|

-Ambulance

Contract |

|

|

|

|

Cash on

hand April 30, 2011 |

|

437,260 |

|

|

+Taxes

Collected in June & Sept ‘11 (568,975

levied in Nov ’10) |

584,169 |

|

|

|

+Other

Revenues |

13,094 |

|

|

|

+Proceeds

from Asset Sales |

|

|

|

|

+/-

discrepancy |

|

|

|

|

-Operational Costs |

290,762 |

|

|

|

-District Expenses |

141,489 |

|

|

|

-Ambulance

Contract |

36,400 |

|

|

|

Cash

on hand April 30, 2012 |

|

565,872 |

|

|

+Taxes

Collected in June & Sept ‘12 (593,111

levied in Nov ’11) |

567,744 |

|

|

|

+Other

Revenues |

10,710 |

|

|

|

+Proceeds

from Asset Sales |

|

|

|

|

+/-

discrepancy |

|

|

|

|

-Operational Costs |

83,675 |

|

|

|

-District Expenses |

294,431 |

|

|

|

-Ambulance

Contract |

145,379 |

|

|

|

Cash

on hand April 30, 2013 |

|

620,841 |

|

|

+Taxes

Collected in June & Sept ‘13 (605,754

levied in Nov ’12) |

593,114 |

|

|

|

+Other

Revenues |

12,073 |

|

|

|

+Proceeds

from Asset Sales |

|

|

|

|

+/- discrepancy |

|

|

|

|

-Operational Costs |

428,976 |

|

|

|

-District Expenses |

173,460 |

|

|

|

-Ambulance

Contract |

163,085 |

|

|

|

Cash

on hand April 30, 2014 |

|

460,507 |

|

|

+Taxes

Collected in June & Sept ‘14 (616,874

levied in Nov ’13) |

605,059 |

|

|

|

+Other

Revenues |

10,902 |

|

|

|

+Proceeds

from Asset Sales |

|

|

|

|

+/-

discrepancy |

551 |

|

|

|

-Operational Costs |

488,856 |

|

|

|

-District Expenses |

172,881 |

|

|

|

-Ambulance

Contract |

186,065 |

|

|

|

Cash

on hand April 30, 2015 |

|

229,217 |

|

|

+Taxes

Collected in June & Sept ‘15 (624,913

levied in Nov ’14) |

616,861 |

|

|

|

+Other

Revenues |

10,658 |

|

|

|

+Proceeds

from Asset Sales |

20,000 |

|

|

|

+/-

discrepancy |

2929 |

|

|

|

-Operational Costs |

303,857 |

|

|

|

-District Expenses |

202,441 |

|

|

|

-Ambulance

Contract |

119,684 |

|

|

|

Cash on

hand April 30, 2016 |

|

253,683 |

|

|

+Taxes

Collected in June & Sept ‘16 (632,121

levied in Nov ’15) |

624,598 |

|

|

|

+Other

Revenues |

16,001 |

|

|

|

+Proceeds

from Asset Sales |

26,200 |

|

|

|

+/-

discrepancy |

-409 |

|

|

|

-Operational Costs |

314,542 |

|

|

|

-District Expenses |

195,654 |

|

|

|

-Ambulance

Contract |

104,504 |

|

|

|

Cash

on hand April 30, 2017 |

|

305,373 |

|

|

+Taxes

Collected in June & Sept ‘17 (639,230

levied in Nov ’16) |

631,263 |

|

|

|

+Other

Revenues |

9,285 |

|

|

|

+Proceeds

from Asset Sales |

|

|

|

|

+/-

discrepancy |

1,070 |

|

|

|

-Operational Costs |

270,531 |

|

|

|

-District Expenses |

197,079 |

|

|

|

-Ambulance

Contract |

115,000 |

|

|

|

Cash

on hand April 30, 2018 |

|

364,381 |

|

|

+Taxes

Collected in June & Sept ‘18 (655,198

levied on Nov 13, 2017) |

637,694 |

|

|

|

+Other

Revenues |

15,327 |

|

|

|

+Proceeds

from Asset Sales |

274,659 |

|

|

|

+/-

discrepancy |

-3,864 |

|

|

|

-Operational Costs |

120,541 |

|

|

|

-District Expenses |

301,105 |

|

|

|

-Fire

& Ambulance Contract |

262,500 |

|

|

|

Cash

on hand April 30, 2019 |

|

604,051 |

|

|

+Taxes

Collected in June & Sept ‘19 (671,128

levied on Nov 12, 2018) |

approx. 660,000 |

|

|

|

+Other

Revenues |

,000 |

|

|

|

+Proceeds

from Asset Sales |

,000 |

|

|

|

+/-

discrepancy |

,000 |

|

|

|

-Operational Costs |

,000 |

|

|

|

-District Expenses |

,000 |

|

|

|

-Fire

& Ambulance Contract |

450,000 |

|

|

|

Cash on

hand April 30, 2020 |

|

,000 |

|

|

+Taxes

Collected in June & Sept ‘20 (687,892

levied in Nov, 2019) |

approx. 670,000 |

|

|

|

+Other

Revenues |

,000 |

|

|

|

+Proceeds

from Asset Sales |

,000 |

|

|

|

+/-

discrepancy |

,000 |

|

|

|

-Operational Costs |

,000 |

|

|

|

-District Expenses |

,000 |

|

|

|

-Fire

& Ambulance Contract |

496,000 |

|

|

|

Cash

on hand April 30, 2021 |

|

,000 |

|

|

+Taxes

Collected in June & Sept ‘21 (_______

levied in Nov, 2020) |

,000 |

|

|

|

+Other

Revenues |

,000 |

|

|

|

+Proceeds

from Asset Sales |

,000 |

|

|

|

+/-

discrepancy |

,000 |

|

|

|

-Operational Costs |

,000 |

|

|

|

-District Expenses |

,000 |

|

|

|

-Fire

& Ambulance Contract |

approx. 510,000 |

|

|

|

Cash

on hand April 30, 2022 |

|

,000 |

Nota Bene: “Cash on Hand” is the sum of the three bank account balances.

“Taxes Collected” is listed in the FFPD

statement as “Total Lake County Collector.”

“Other Revenues” is the amount listed as “Total Income” except for

“Taxes Collected.”

“Proceeds from Asset Sales” is any listing in the FFPD statement

as “Sale of Assets.”

“District Expenses” is listed as “Administration” plus “Building

Operations” plus “New Building” through 2012 and “Total District Expense” plus

Total District” subsequently.

“Ambulance Contract” is as listed in the FFPD statement.

“Fire & Ambulance Contract” is according to the Fire And Ambulance Service Intergovernmental Agreement.

“Operational Costs” is the amount listed as “Total Expenses”

except for “District Expenses” and “Proceeds From

Asset Sales” and “[Fire &] Ambulance Contract” but including the amount

listed as Net Other Income.”

“discrepancy” is the difference between the net amount of the

journal balances for a given period and the change in the two ledger balances

bracketing that period.

All source data was supplied

by RFPD but any error of

interpretation is mine. -Don Russ

The purpose of the following table is to

compare the amount of tax money historically spent by the Fire Board and the

amount of tax money that the Fire Board has levied upon the property owners

within the District to the amount needed for annual payments of our new Service

Agreement with Libertyville and Lake Forest for the District. The green and red shading are provided only

to facilitate comparison – green-amounts are in the $500 thousands and

red-shaded amounts are in the $600 thousands.

|

|

FY

ending April

30 |

Spending |

Levy ordered the previous November(1) |

Intergovernmental Service Agreement Payment(2) |

|

|

|

2010 |

366,748 |

567,311 |

|

|

|

|

2011 |

433,392 |

584,542 |

|

|

|

|

2012 |

468,651 |

568,975 |

|

|

|

|

2013* |

523,485 |

593,111 |

|

|

|

|

2014* |

765,521 |

605,754 |

|

|

|

|

2015* |

847,251 |

616,874 |

|

|

|

|

2016* |

623,052 |

624,913 |

|

|

|

|

2017* |

615,109 |

632,121 |

|

|

|

|

2018* |

581,540 |

639,230 |

|

|

|

|

2019 |

688,010 |

655,198 |

262,500 |

(3,4)

|

|

|

2020* |

|

671,128 |

450,000 |

(4) |

|

|

2021* |

|

687,892 |

496,000 |

(4) |

|

|

2022* |

|

|

510,000 |

(5) |

|

|

2023* |

|

|

525,000 |

(5) |

|

|

2024* |

|

|

540,000 |

(5) |

|

|

2025* |

|

|

555,000 |

(5) |

|

|

2026 |

|

|

570,000 |

(5) |

|

|

2027 |

|

|

585,000 |

(5) |

|

|

2028 |

|

|

600,000 |

(5) |

|

|

2029 |

|

|

615,000 |

(5) |

|

|

2030 |

|

|

630,000 |

(5) |

*One

of the six years prior or following the transition year.

(1)..The Fire Board passes a resolution every November

instructing the County Collector how much real estate tax to collect the

following June and September from District residents. It is posted on the row that corresponds to

the fiscal year in which those collections are to be made.

(2)..This is the Fire And Ambulance Service Intergovernmental

Agreement which the Fire Board entered into on September 11, 2018 and took

effect on October 1, 2018.

(3)..Since the Agreement covered only seven months of the

first fiscal year (October 1st through April 30th) the

payment is only 7/12 of $450,000.

(4)..The payment in each of the first three years is a sum

certain, specified to the dollar in the Agreement.

(5)..In

FY 2022 and beyond, the Agreement provides for inflation, to wit: “…the Annual Service Fee to be paid by the

District shall increase based on the change in the Consumer Price Index

("CPI") as defined in the Property Tax Extension Limitation Law (35

ILCS 200/18-185); provided, however, that the Annual Service Fee will not

increase by more than the CPI or 4%, whichever is less.”

I

used a $15,000 increase each year which is probably high based on recent CPI

experience:

|

|

April To April |

CPI calculation |

|

|

2013 |

232.531/230.085=1.0106 or 1.06% |

|

|

2014 |

237.072/232.531=1.0195 or 1.95% |

|

|

2015 |

236.599/237.072=0.998004 or -2% |

|

|

2016 |

239.261/236.599=1.0113 or 1.13% |

|

|

2017 |

244.524/239.261=1.02200 or 2.2% |

|

|

2018 |

250.546/244.524=1.0246 or 2.46% |

|

|

2019 |

255.548/250.546=1.0199644 or 2% |

Notice that a one percent

increase in a half-million dollars is $5,000, not $15,000.

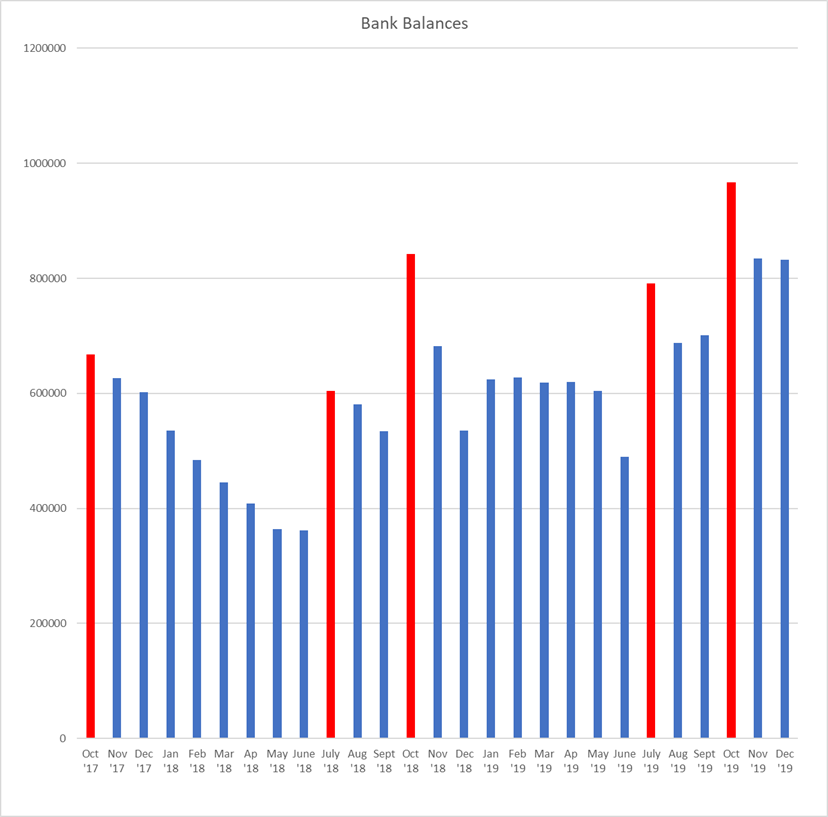

The numbers above this point, with the exception

of the April 30 “Cash On Hand” amounts, represent

annual cash flows. The bar chart below

reports monthly cash-on-hand levels that were found in the minutes posted on

the District’s website. (They are posted

to the reporting month and relate to the prior month-end) Starting September

2018, the District has made quarterly payments for the Fire & Rescue

Services contract every June, September, December and March. The only significance of the bar colors is to

indicate (in red) the months when real estate tax revenues are received. Notice that the balance reported in October

2019 (for September 30th) is the highest level of liquidity realized

in the entire history of the District.

FOUR NUMBERS:

Let’s say you have an appointment with

your doctor. Regardless of the reason for the appointment, the first thing they

do is to take basic measurements. They take

your temperature, blood pressure and other “vital statistics” because these are

the “objective facts” that any assessment demands.

Every financial entity also has vital

statistics. In the case of the RFPD they

are:

Annual Spending rate $659K p.a. (2013 – 2018)

Tax Levy Rate $619K p.a. (2013 – 2018)

Service Contract Rate $513K p.a. (2020 – 2025)

Cash on hand $834K (October 31, 2019)

These four numbers are objective facts that

define the history, health and direction of the District. Presented most simply, they are:

Spending 659

Levy 619

Contract 513

Cash 834

These are the vital statistics of the

RFPD.

The District fiscal year (FY) ended on

April 30, 2019 was a transition year.

For the first five months, we contracted for ambulance service. For the last seven months, we contracted for

ambulance and fire service.

Six years is a time period long enough

to establish an annual rate independent of annual fluctuation. The corresponding levy rate is more

stable. They do not reach so far into

the past as to be irrelevant to current operations. The future contract payments are also more

stable, adjusting for inflation only.

The first two vital statistics (659 and

619) are six-year averages of the actual behavior of the District prior to the

transition year. The annual contract

payment of 513 is an average of what we can expect at worst (most expensive) in

the six years following the transition year.

Notice that if inflation adjustments were only one percent p.a. then

instead of 513, the third vital statistic would be 497.

So the

first two numbers lag the third by seven years.

Inflation has been running about two percent per year in recent years,

and two percent compounded yearly for seven years is about fifteen

percent. So, to make the first two

numbers comparable to the third we might add $100 thousand to each of them as

follows:

Spending 659

+ 100

Levy 619

+ 100

Contract 513

Cash 834

That adjustment, however, does not

change the revealed history, health or direction of the District, as shall be

shown.

During the entire six-year period from

FY2013 through FY2018 inclusive, the district contracted for ambulance service

of several hundred calls per year. The

District serviced its own fire calls.

The district experiences “three or four” structure fires per year,

according to a past district official.

Total District spending is constrained

to ambulance and fire service only.

During the entire future six-year period from FY 2020 through 2025

inclusive, the ambulance and fire mission of the district is entirely addressed

by the 513. Any spending in excess of

513 is either a matter of administration (the lawyer and the website) of a

matter of cleaning-up past mistakes (the firehouse and the CRC.)

Firehouse costs are correctly reflected in

the 659 average spending level of the six years prior to the transition year

because our commitment to self-service fire calls requires not only a truck and

crew, but also the firehouse. The

decision of a prior board to build an expensive, five-bay firehouse is a sunk

cost and is not to be second-guessed to any useful end for this analysis.

The imminent disposition of the

firehouse, whether privately or through an eminent domain action, will

extinguish the related mortgage and the District will realize residual equity

as an increase of cash on hand. In other

words, firehouse costs are correctly NOT reflected in the 513 average contract

payment of the six years following the transition year. Notice however that if they were, the

effective cost (post-disposition) of the contract would be reduced.

This analysis is not an exercise in

cash-flow planning. It is possible to

become so distracted by bank fees and office supplies that one cannot see the

forest for the trees. This analysis is

concerned with broad objective facts that are summarized by these four vital

statistics of the District:

Prior

Spending 659

Prior

Levy 619

Future

Contract 513

Cash 834

It is instructive to note however that

the very existence of the Citizens Review Committee has hindered the

realization of the benefits arising from the disposition of the firehouse:

“After the meeting, Klujian

said he wanted to use the property for his work, and he does have the cash on

hand to process the transaction. However, he expressed caution about the

animosity that still exists with some Knollwood residents over the prior

board’s decision to outsource the community’s fire department services to the

point that a citizen’s committee is scheduled to start meeting next month to

examine the decision.

“’I’m hoping this is something I can do,

but I only want to be in there if an overwhelming majority of the citizens

approve of this,’ Klujian said.”

CONCLUSIONS:

In the Scope Section of our 3-ring

notebooks, Board Secretary Bernstein poses 14 issues. The first three are “financial” and are: (1) What is the financial impact of

outsourcing services vs. what was established as the former Knollwood Fire

Department, (2) what are the current operating costs vs. prior to Oct. 2018,

and (3) what will the future costs be for the RFPD for the next 5 years?

(1) What is the financial impact of

outsourcing services vs. what was established as the former Knollwood Fire

Department?

The

answer is 659 minus 513, annually.

659

(or 759, to make it comparable) was the established cost for the RFPD to

perform its essential mission of ambulance and fire service, that is: $659 thousand p.a.

The

annual cost of the IGA that fully addresses the essential mission is 513 – $513

thousand p.a., plus the lawyer and the website.

That is a savings of some ten thousand dollars per month.

Every

month, patch.com publishes a list of new foreclosures featuring five of

them. These are the homes of our

neighbors who had to move away because they could not afford to live here. As I write this, realtor.com lists fourteen

homes in the Lake Bluff and Lake Forest zip codes that are currently offered

for sale because of foreclosures. We

could ask those neighbors what they think about the RFPD squandering $10

thousand per month, every month, month after month after month. Except that they are ex-neighbors now.

(2) What are the current operating costs

vs. prior to Oct. 2018?

The answer is 659 minus 513, annually.

659 (or 759, to make it comparable) was

the established cost for the RFPD to perform its essential mission of ambulance

and fire service, that is: $659 thousand

p.a.

The annual cost of the IGA that fully

addresses the essential mission is 513 – $513 thousand p.a., plus the lawyer

and the website. That is a savings of

some ten thousand dollars per month.

Every week, patch.com publishes a list

of new foreclosures. These are the homes

of our neighbors who had to move away because they could not afford to live

here. As I write this, realtor.com lists

fourteen homes in the Lake Bluff and Lake Forest zip codes that are currently

offered for sale because of foreclosures.

We could ask those neighbors what they think about the RFPD squandering

$10 thousand per month, every month, month after month after month. Except that they are ex-neighbors now.

(3) What will the future costs be for

the RFPD for the next 5 years?

The answer is 513, plus administration,

per year.

The annual cost of the IGA that fully

addresses the essential mission of the District is 513 – $513 thousand p.a.

(plus the lawyer and the website).

Recall the District’s vital statistics:

Prior Spending 659

Prior Levy 619

Future Contract 513

Cash 834

Notice that the levy level of 619 (or

719, to make it comparable) exceeds 513 by about $100 thousand (or $200 thousand)

p.a., which means that every 12 months the District takes the equivalent of

14.5 months of contract payments from the taxpayers. The surplus is far in excess of the cost of

the lawyer and the website.

And notice further that the annual levy

could be entirely suspended for a year to no ill effect. The District has $834 thousand (according to

the most recently published minutes, those of the November 11th

meeting) of idle cash sitting in the bank.

That is the equivalent of 19.5 months of contract payments. If there are 756 households in Knollwood and

The Sanctuary, then the 834 represents $1,100 on average that would have

otherwise been part of the bank balances of those households. There is no other local tax district that has

such deep reserves.

Prior

to the new contract, annual operations were 659 minus 619; that is to say: Our spending exceeded our

levy. In the private sector, that cannot

continue for long. Inefficiencies and

bad decisions drive private entities to bankruptcy. Bankruptcy is inherently a private-sector

phenomenon, however. In the public

sector, such as the RFPD, the public entity simply raises taxes to pay for its

inefficiencies and bad decisions.

Prior to the new contract, annual

operations were 659 minus 619, which is to say we were headed for either

“bankruptcy” or higher taxes.

Post-contract, we are levying 14.5 months of contract payments every

year even though we have 19.5 months of contract payments sitting in the bank. And that’s not counting the windfall from

selling the firehouse.

RFPD is not a community center. It has no business spending the taxpayers’

money on “making Knollwood a friendly, happy place.” It is a tax district. Its sole mission is to provide adequate fire

& rescue for the minimal price. The

new contract does that much better than the self-service arrangement.